All about Real Estate Reno Nv

Table of ContentsAll about Real Estate Reno NvWhat Does Real Estate Reno Nv Do?Get This Report about Real Estate Reno NvReal Estate Reno Nv Things To Know Before You Get This

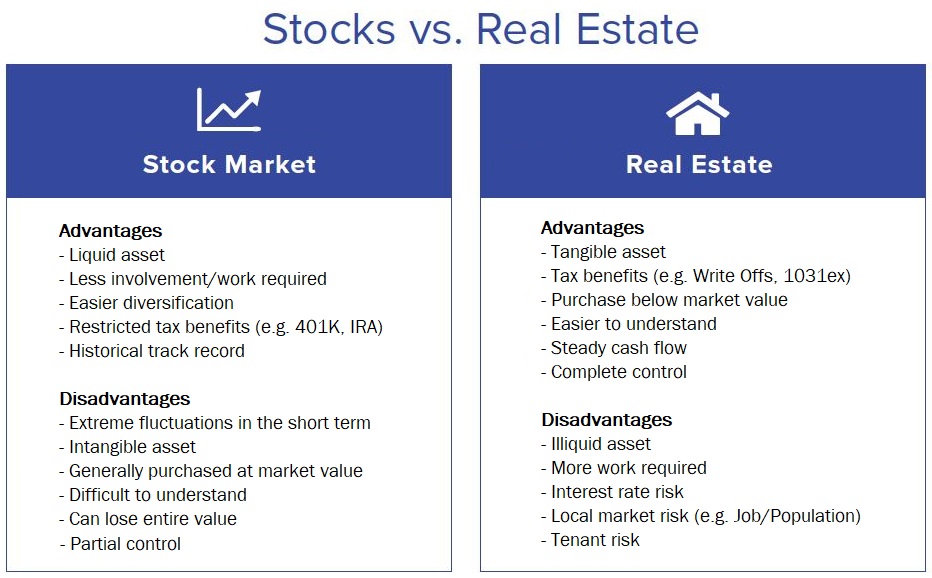

That might appear pricey in a globe where ETFs and shared funds may bill as low as zero percent for creating a varied portfolio of supplies or bonds. While platforms might vet their investments, you'll need to do the exact same, which indicates you'll need the abilities to evaluate the opportunity.Caret Down Resources recognition, dividend or passion repayments. Like all investments, realty has its pros and cons. Below are a few of the most crucial to keep in mind as you evaluate whether or not to buy realty. Long-term recognition while you live in the residential or commercial property Potential bush versus inflation Leveraged returns on your financial investment Passive earnings from rental fees or with REITs Tax benefits, including rate of interest reductions, tax-free capital gains and devaluation write-offs Fixed long-lasting funding available Recognition is not guaranteed, particularly in economically depressed locations Residential or commercial property costs might fall with higher rate of interest prices A leveraged investment implies your deposit is at risk Might call for significant money and time to manage your very own residential or commercial properties Owe an established home mortgage payment monthly, also if your lessee does not pay you Lower liquidity for genuine residential property, and high payments While property does provide numerous benefits, particularly tax obligation benefits, it does not come without significant disadvantages, particularly, high compensations to leave the marketplace.

Do you have the resources to pay a home loan if a lessee can not? Just how much do you rely on your day job to maintain the investment going? Willingness Do you have the wish to act as a landlord? Are you ready to collaborate with lessees and comprehend the rental laws in your area? Or would certainly you choose to assess offers or financial investments such as REITs or those on an online system? Do you wish to satisfy the needs of running a house-flipping company? Expertise and skills While lots of investors can discover on duty, do you have special skills that make you better-suited to one kind of investment than one more? Can you assess stocks and build an eye-catching portfolio? Can you fix your rental residential or commercial property or take care of a fin and save a bundle on paying experts? The tax obligation benefits on property differ extensively, depending upon exactly how you invest, however purchasing property can provide some large tax obligation benefits. Real Estate Reno NV.

How Real Estate Reno Nv can Save You Time, Stress, and Money.

REITs provide an appealing tax account you will not sustain any type of capital gains taxes till you market shares, and you can hold shares actually for decades to avoid the tax male. look at more info As a matter of fact, you can pass the shares on your beneficiaries and they won't owe any tax obligations on your gains.

Realty can be an appealing investment, but investors wish to be certain to match their kind of financial investment with their desire and capability to manage it, consisting of time dedications. If you're seeking to produce income during retired life, property investing can be one method to do that.

There are numerous benefits to buying realty. Consistent revenue flow, strong returns, tax advantages, diversification with well-chosen assets, and the ability to take advantage of wide range with real estate are all advantages that investors may enjoy. Below, we dive right into the different advantages of buying realty in India.

Some Ideas on Real Estate Reno Nv You Need To Know

Realty has a tendency to value in worth in time, so if you make a wise financial investment, you can profit when it comes time to offer. Gradually, rental fees also have a tendency to boost, which could increase capital. Rental fees raise when economic climates broaden due to the fact that there is even more need for real estate, which increases funding worths.

If you are still working, you might increase your rental revenue by spending it following your economic purposes. There are numerous tax obligation advantages to genuine estate investing.

It will substantially minimize taxable revenue while reducing the expense of actual estate a knockout post investing. Tax reductions are supplied for a variety of prices, such as firm expenses, money circulation from other assets, and home mortgage rate of interest.

Property's web link to the other primary asset teams is fragile, sometimes even unfavorable. Real estate may therefore minimize volatility and boost return on danger when it is consisted of in a portfolio of numerous assets. Compared to various other assets like the stock exchange, gold, cryptocurrencies, and banks, buying property can be substantially more secure.

The Best Strategy To Use For Real Estate Reno Nv

The stock exchange is continually anonymous changing. The property market has expanded over the previous numerous years as an outcome of the execution of RERA, lowered home mortgage rates of interest, and various other variables. Real Estate Reno NV. The rate of interest on financial institution savings accounts, on the various other hand, are reduced, specifically when contrasted to the climbing inflation